In an era where financial literacy is paramount, budgeting apps have emerged as indispensable tools for individuals seeking to take control of their finances. These applications provide users with the ability to create, manage, and adjust budgets in real-time, allowing for a more proactive approach to personal finance. By offering features such as expense categorisation, income tracking, and visual representations of spending habits, budgeting apps empower users to make informed decisions about their financial futures.

For instance, apps like YNAB (You Need A Budget) encourage users to allocate every pound they earn to specific expenses or savings goals, fostering a sense of accountability and discipline. Moreover, the integration of budgeting apps with bank accounts and credit cards has revolutionised the way individuals monitor their financial activities. This connectivity allows for automatic transaction imports, which can significantly reduce the time spent on manual entry.

Users can set up alerts for overspending in certain categories or reminders for upcoming bills, ensuring that they remain aware of their financial standing at all times. The gamification elements found in some budgeting apps, such as rewards for meeting savings goals or challenges to reduce spending, can also enhance user engagement and motivation. As a result, budgeting apps not only facilitate better financial management but also promote healthier financial habits.

Summary

- Budgeting apps help you take control of your finances by tracking your income and expenses, setting budgets, and providing insights into your spending habits.

- Investment tracking apps make it easy to monitor your portfolio, track market trends, and make informed investment decisions.

- Expense tracking apps allow you to keep tabs on your spending habits, categorize expenses, and identify areas where you can cut back.

- Bill payment apps help you stay organized and never miss a payment again by scheduling and automating bill payments.

- Savings apps can help you reach your financial goals faster by setting savings targets, providing savings tips, and offering high-yield savings account options.

Investment Tracking Apps: Monitor Your Portfolio with Ease

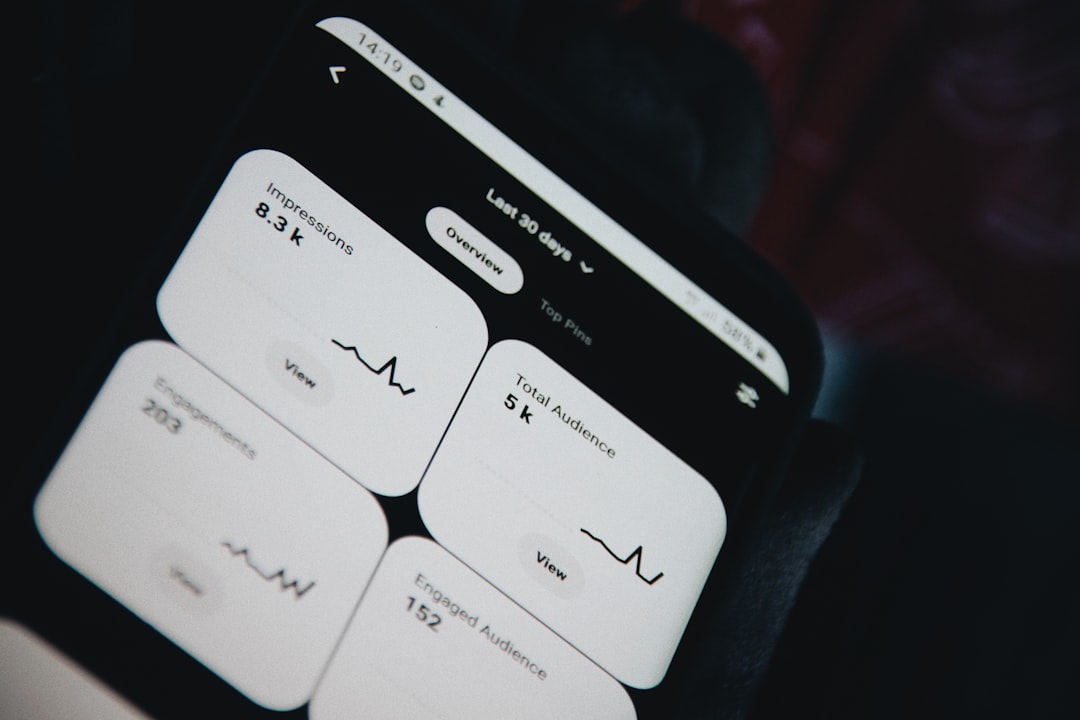

Investment tracking apps have become essential for both novice and seasoned investors looking to keep a close eye on their portfolios. These applications provide a comprehensive overview of various investments, including stocks, bonds, mutual funds, and cryptocurrencies. By aggregating data from multiple accounts into a single platform, users can easily assess their overall financial health and make informed decisions about their investment strategies.

For example, apps like Personal Capital offer detailed analytics on asset allocation and performance metrics, enabling users to identify trends and adjust their portfolios accordingly. Furthermore, investment tracking apps often include features such as real-time market data, news updates, and alerts for significant price changes. This information is crucial for investors who need to stay informed about market fluctuations and economic indicators that may impact their investments.

Some apps even provide educational resources and tools for analysing potential investments, making them invaluable for those looking to expand their knowledge in the field. By utilising these apps, investors can not only monitor their current holdings but also strategise for future growth and diversification.

Expense Tracking Apps: Keep Tabs on Your Spending Habits

Expense tracking apps serve as a vital resource for individuals aiming to gain insight into their spending habits. By meticulously recording every transaction, these applications allow users to identify patterns in their expenditures and make necessary adjustments to their financial behaviour. For instance, an app like Expensify enables users to scan receipts and categorise expenses automatically, streamlining the process of tracking spending across various categories such as dining, entertainment, and groceries.

This level of detail can reveal surprising insights into where money is being spent and highlight areas where cuts can be made. In addition to providing a clear picture of spending habits, expense tracking apps often feature budgeting tools that allow users to set limits on specific categories. This functionality encourages users to remain mindful of their spending and fosters a sense of discipline when it comes to financial management.

Many apps also offer visual representations of spending trends through graphs and charts, making it easier for users to comprehend their financial situation at a glance. By utilising expense tracking apps, individuals can cultivate a greater awareness of their financial behaviours and work towards more sustainable spending practices.

Bill Payment Apps: Never Miss a Payment Again

| App Name | Features | Supported Platforms | Security Measures |

|---|---|---|---|

| App 1 | Bill reminders, payment scheduling | iOS, Android | Two-factor authentication, encryption |

| App 2 | Auto bill detection, budget tracking | iOS, Android, Web | Fingerprint login, data encryption |

| App 3 | Multiple payment methods, bill categorisation | iOS, Android, Windows | Biometric authentication, secure servers |

Bill payment apps have transformed the way individuals manage their recurring expenses by providing a streamlined solution for tracking and paying bills. These applications allow users to input their various bills—such as utilities, rent, and subscriptions—and set reminders for due dates. This feature is particularly beneficial for those who juggle multiple payments each month, as it reduces the risk of late fees and service interruptions.

For example, an app like Prism consolidates all bills into one platform, allowing users to view upcoming payments and make payments directly from the app. Additionally, many bill payment apps offer features such as automatic payments and notifications when bills are due or when payment has been successfully processed. This level of automation not only saves time but also alleviates the stress associated with managing multiple payment deadlines.

Some apps even provide insights into spending patterns related to bills, helping users identify areas where they might be able to cut costs or negotiate better rates with service providers. By leveraging bill payment apps, individuals can ensure that they stay on top of their financial obligations without the hassle of manual tracking.

Savings Apps: Reach Your Financial Goals Faster

Savings apps have gained popularity as effective tools for individuals looking to achieve specific financial goals more efficiently. These applications often incorporate features that encourage users to save money automatically or set aside funds for particular objectives, such as vacations or emergency funds. For instance, an app like Qapital allows users to create rules that trigger savings based on everyday activities—such as rounding up purchases or saving a set amount every time they make a purchase—making the process of saving feel less burdensome.

Moreover, many savings apps provide visual progress trackers that display how close users are to reaching their goals. This feature can serve as a powerful motivator, encouraging individuals to remain committed to their savings plans. Some apps also offer high-yield savings accounts or investment options that allow users to grow their savings over time while still maintaining easy access to their funds.

By utilising savings apps effectively, individuals can cultivate a proactive approach to saving that aligns with their long-term financial aspirations.

Credit Score Monitoring Apps: Stay on Top of Your Credit Health

In today’s credit-driven society, maintaining a healthy credit score is crucial for securing loans, mortgages, and even rental agreements. Credit score monitoring apps provide individuals with the tools necessary to keep track of their credit health in real-time. These applications typically offer features such as regular credit score updates, alerts for significant changes in credit reports, and personalised tips for improving credit scores.

For example, Credit Karma not only provides users with access to their credit scores but also offers insights into factors affecting their scores and recommendations for credit products that may suit their needs. Additionally, many credit score monitoring apps allow users to dispute inaccuracies on their credit reports directly through the platform. This functionality is essential for individuals who may be unaware of errors that could negatively impact their credit scores.

By regularly monitoring their credit health through these apps, users can take proactive steps to improve or maintain their scores over time. The ability to understand the intricacies of credit scoring can empower individuals to make informed financial decisions that align with their long-term goals.

Tax Filing Apps: Simplify the Tax Filing Process

Tax filing can often be a daunting task for many individuals; however, tax filing apps have emerged as valuable resources that simplify this process significantly. These applications guide users through the complexities of tax preparation by providing step-by-step instructions and automated calculations based on user inputs. For instance, TurboTax offers a user-friendly interface that allows individuals to input their income information and deductions easily while ensuring compliance with current tax laws.

Moreover, tax filing apps often include features such as document storage and e-filing capabilities that streamline the entire process. Users can upload relevant documents directly into the app and submit their tax returns electronically, reducing the likelihood of errors associated with manual entry. Many tax filing apps also provide access to tax professionals who can offer personalised advice or answer questions during the filing process.

By leveraging these tools, individuals can navigate tax season with greater confidence and efficiency.

Personal Finance Management Apps: All-in-One Solutions for Financial Success

Personal finance management apps have emerged as comprehensive solutions that encompass various aspects of financial management within a single platform. These applications typically combine budgeting tools, expense tracking features, investment monitoring capabilities, and savings goals into one cohesive interface. For example, Mint offers users the ability to track spending across multiple accounts while providing insights into budgeting and investment performance—all from one app.

The convenience of having all financial information in one place cannot be overstated; it allows users to gain a holistic view of their financial situation without having to switch between multiple applications. Many personal finance management apps also incorporate educational resources that help users improve their financial literacy over time. By utilising these all-in-one solutions effectively, individuals can streamline their financial management processes and work towards achieving greater financial stability and success in an increasingly complex economic landscape.

FAQs

What are finance management apps?

Finance management apps are software applications designed to help individuals and businesses track, manage, and optimize their financial activities. These apps typically offer features such as budgeting, expense tracking, bill payment reminders, investment tracking, and financial goal setting.

What are the benefits of using finance management apps?

Using finance management apps can help individuals and businesses gain better control over their finances. These apps can provide real-time insights into spending habits, help in creating and sticking to a budget, track investments, and streamline bill payments. They can also help in setting and achieving financial goals.

What features should I look for in a finance management app?

When choosing a finance management app, it’s important to look for features such as expense tracking, budgeting tools, bill payment reminders, investment tracking, goal setting, and the ability to sync with bank accounts and credit cards. Some apps may also offer additional features such as credit score monitoring and financial reports.

Are finance management apps secure?

Most finance management apps use encryption and other security measures to protect users’ financial data. It’s important to choose a reputable app from a trusted developer and to regularly update the app to ensure it has the latest security features. Additionally, users should use strong, unique passwords and enable two-factor authentication when available.

Are finance management apps suitable for businesses?

Yes, many finance management apps offer features specifically designed for businesses, such as invoicing, expense tracking for employees, and integration with accounting software. These apps can help businesses streamline their financial processes and gain better insights into their cash flow and financial health.